property purchase tax in france

Buying property in France you pay. In the overwhelming majority of departments the taxes amount to 580.

Taxe D Habitation French Residence Tax

Fully translated in English.

. The 172 French social charges cannot be offset against UK tax. Ad 100000 properties in France. This is payable at the end of each year in December and can also be paid monthly.

For the residents of the EU the tax rate is 19. We Can Help With Your French Tax Return. Depending on when you purchase a property in France and your personal circumstances.

Foreign nationals are permitted to buy residential and commercial property in France as individuals or through a legal entity. 100000 privates houses in all of France. If you are renting out a French property the net income will be taxed at the scale rates of income tax.

It is payable by the individual who owns the property on the 1st. There is some variation in the level of the taxes depending on the department in which the property is situated. French income tax.

- registration fees also called the notary fees around 75 of the purchase price - pro rata land tax the seller pays this annual tax but you repay the. Because the notary will calculate and charge all the relevant taxes during the purchase process you will. Ad Do You Own Rental Property in France.

In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of. In 2018 France abolished wealth tax on financial assets replacing it with IFI Impôt sur la Fortune Immobilière which is only applicable to real estate assets. Ad Do You Own Rental Property in France.

In French its known as droit de mutation. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary. There is no exemption.

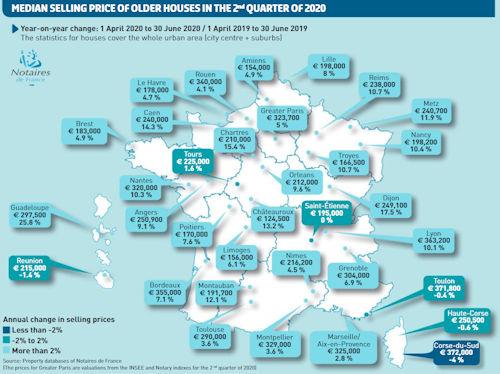

The Wealth tax kicks in for French households whose combined worldwide assets are. French property tax for dummies. The rate of stamp duty varies slightly between the departments of France and depending on the age of the property.

Non-residents of France may also have a wealth tax liability but only on their French property assets. There are two different taxes for property owners in France. We Can Help With Your French Tax Return.

If you are renting out a French property the net income will be taxed at the scale rates of income tax ranging from 11 for income over 10084 to 45. Here is how it is calculated. The initial purchase of a property in France will incur various fees and taxes.

There are two main property taxes in France plus a wealth tax according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in London and Nice France. Any person living abroad and owner of real estate in France is subject to French property tax. The French taxe foncière is an annual property ownership tax which is payable in October every year.

If a French non-resident is a resident of a non-cooperating state such as Brunei or Guatemala the rate is 75. The first one is the taxe FONCIERE or land tax the second one is the taxe dHABITATION council tax which is. Houses Villas Apartments for sale on Green-Acres.

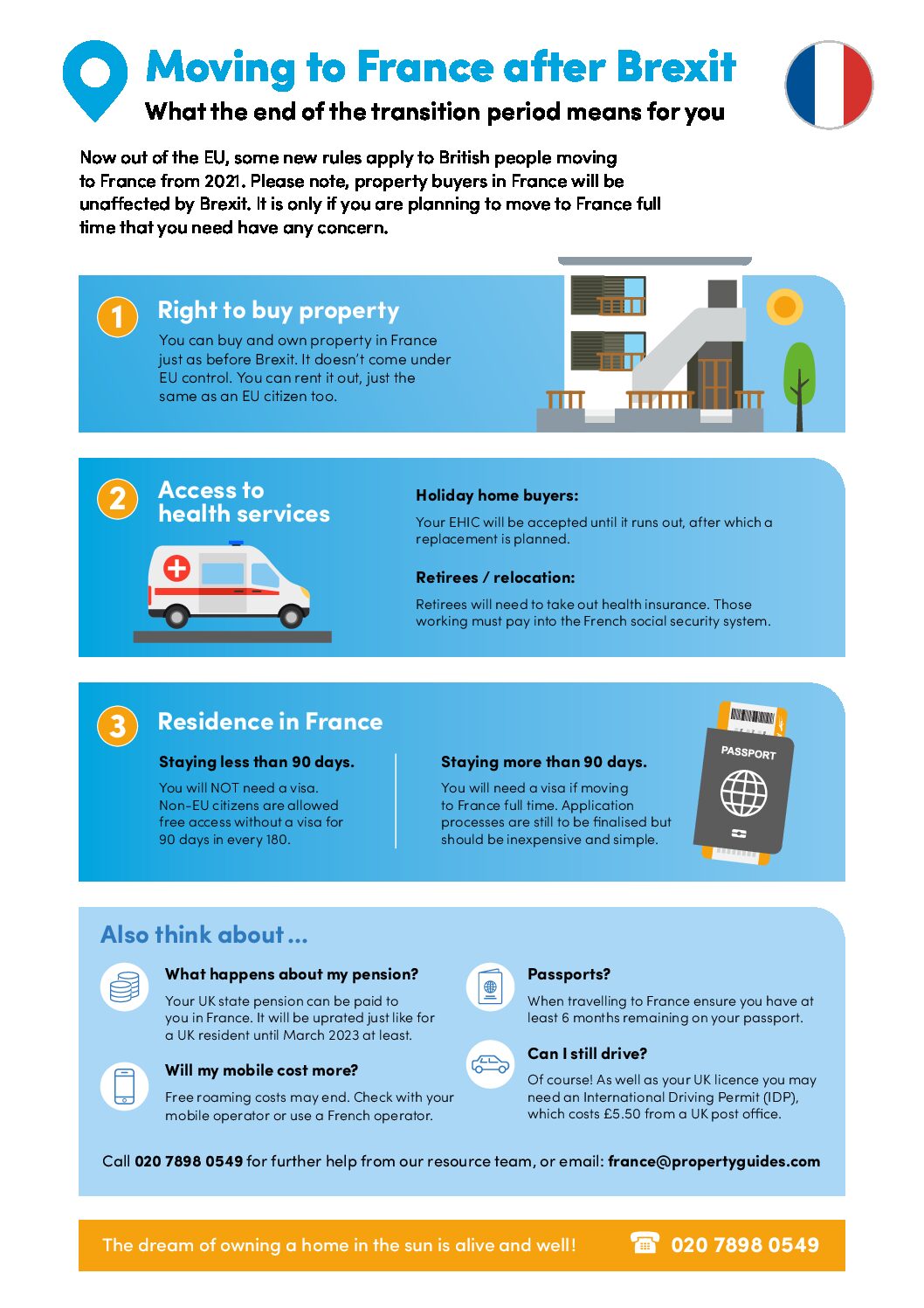

Buying Property In France After Brexit France Property Guides

Why You Should Buy A House In France In 2022

In Depth Guide To French Property Taxes For Non Residents Expats

French Taxes I Buy A Property In France What Taxes Should I Pay

Taxes In France A Complete Guide For Expats Expatica

French Taxes I Buy A Property In France What Taxes Should I Pay

French Property Tax Considerations Blevins Franks

How To Buy A House Or Property In France

France Tax Income Taxes In France Tax Foundation

Buying A House In France As A Foreigner

French Taxes I Buy A Property In France What Taxes Should I Pay

Buying And Selling A Home In France What Is The Viager System

Own A Holiday Home In France This Ultimate Tax Guide Is For You

France Tax Income Taxes In France Tax Foundation

Own A Holiday Home In France This Ultimate Tax Guide Is For You

France Tax Income Taxes In France Tax Foundation

Taxes In France A Complete Guide For Expats Expatica

Taxes In France A Complete Guide For Expats Expatica

French Inheritance Law Assisting Foreigners Dedicated Services